FY20 Low-to-Moderate Income Energy Efficiency Grant

Main_Content

Please note: this application period has closed. The Maryland Energy Administration ("MEA") announces $5.8 Million in Fiscal Year 2020 ("FY20") Grant Funds available for the Award-Winning Clean Energy Communities Low-to-Moderate Income Grant Program.

# of Grants to nonprofits and local government organizations in fiscal year 2020 (FY20)

|

Range of Grant Amounts

| Annual Cost Savings from All Awards

|

28

| $52,610 - $600,000

| $313,914

|

2020 Program Outcomes

FY20 Year End Report

FY20 Year End Report

MEA congratulates the FY20 LMI Grantees.

FY20 LMI Grantees.

The Fiscal Year 2020 (FY20) Clean Energy Communities Low-to-Moderate Income Grant Program (Program) has an initially allocated budget of $3.3 million, subject to funding availability, from the Strategic Energy Investment Fund (“SEIF”) for energy efficiency projects. The Program funds (“Funds”) are available to entities that serve Maryland’s LMI residents.

Clean Energy Communities LMI grants (Grants) will be competitively awarded for energy efficiency projects that generate significant reductions in energy use and pass on the benefits of the savings to Maryland’s LMI residents. Projects that

maximize energy savings per dollar of MEA investment and the

number of LMI residents served will receive grant funding priority.

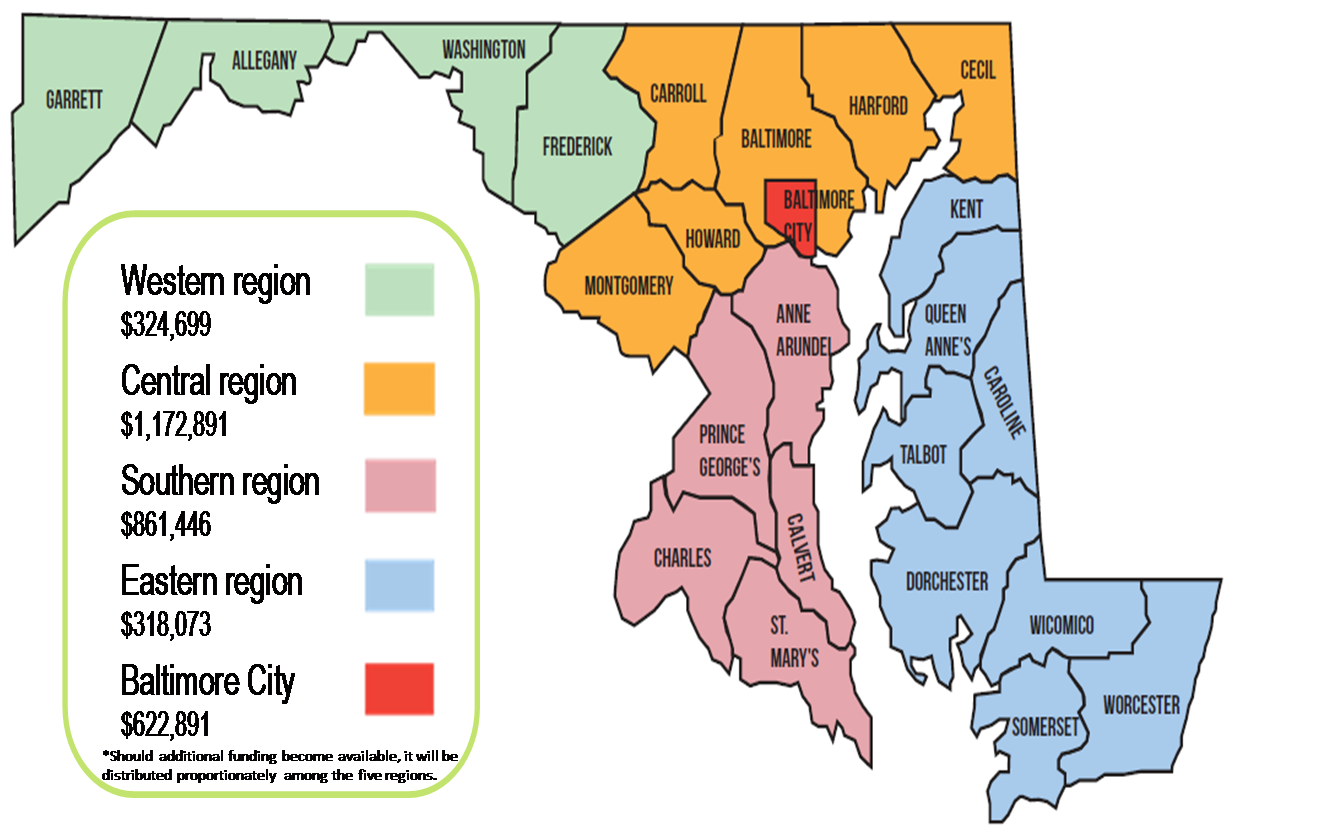

Funds are allocated to each Maryland Region (see map below) based on the number of LMI income households located within the respective Region, in order to ensure an equitable distribution of grant funds. Grants will then be awarded competitively within the applicant pool for each Region.

The map below shows each region’s allocation of funds, which together totals $3.3 million.

Projects implemented by nonprofit organizations and local governments that provide energy efficiency and weatherization measures to LMI Maryland homes, as well as commercial buildings that primarily serve LMI Marylanders (e.g., a homeless shelter), are eligible for grant consideration. For a more detailed description of eligible projects, please refer to the FY20 LMI Grant Program Application Document in the section below titled “How to Apply.”

All construction activities for each project selected for LMI Program grant funding from FY20 must be completed by August 1, 2021 with all invoices and project reports submitted to MEA no later than September 1, 2021.

Project Types

- Whole Home/Building Residential Retrofits: Whole Home/Whole Building upgrades consist of performing a Building Performance Institute level energy audit on the residential home or building and then installing cost-effective energy efficiency and weatherization measures. Examples of installed measures are LED light bulbs, ENERGY STAR® qualified appliance upgrades, insulation improvements, air sealing, etc.

- Whole Building Commercial Retrofits: Similar to the residential retrofits above, an energy audit on a commercial building is performed followed by the installation of cost-effective energy efficiency and weatherization measures to achieve an aggregate simple payback of 15 years or less based on the audit results. Examples of installed measures are LED light bulbs, control upgrades, insulation improvements, air sealing, etc.

- New Construction with Incremental Efficiency Upgrades: New construction projects in which the project aims to improve efficiency to above-code levels. Only the incremental purchase cost of upgrading to a higher level of energy efficiency is reimbursable under the Program.

- Limited Upgrades to Existing Commercial/Residential Buildings: An existing building/home in which the project does not require an energy audit, but rather seeks to make limited cost-effective upgrades to improve the performance and efficiency of the home/building.

More information on eligible project types and measures is located in the Section 3 of the  FY20 Application Form.

FY20 Application Form.

Income Limits

Grants must be used to fund energy efficiency projects that benefit Maryland’s LMI income population. For the purposes of this application, low and moderate income households are defined as:

- Low Income - at or below 175% of the federal poverty level

- Moderate Income - above Low Income, but at or below 85% of median income by county

While grants will be allocated based on region, income limits are based on the particular county in which a project is located. The income limits for “moderate income” for calendar year 2019 can be found on the Maryland Department of Housing and Community Development (DHCD) website. Income eligibility limits for “low income”, which is now established as 175% of the federal poverty level, can be found in the table below.

FY20 Income Eligibility Limits

(Based on 175% of the Federal Poverty Level) |

| Household Size |

Maximum Gross Monthly Income Standards |

Maximum Gross Yearly Income Standards |

| 1 |

$1,821 |

$21,858 |

| 2 |

$2,466 |

$29,593 |

| 3 |

$3,111 |

$37,328 |

| 4 |

$3,755 |

$45,063 |

| 5 |

$4,400 |

$52,798 |

| 6 |

$5,044 |

$60,533 |

| 7 |

$5,689 |

$68,268 |

| 8 |

$6,334 |

$76,003 |

| For Each Additional Person, Add |

$645 |

$7,740 |

Review Criteria

Projects that maximize energy savings per dollar of MEA investment and the number of LMI residents served will receive grant funding priority. In addition, projects which have the flexibility to be scaled up and/or down based on funding availability will be looked at favorably. Primary FY20 review criteria includes:

- Annual energy savings per dollar of MEA investment.

- Impact on Maryland's low-to-moderate income residents.

- Applicant response to the FY20 Application exercise.

- Applicant's past performance complying with LMI program requirements and participating in other State programs.

- Applicant's willingness and ability to deliver energy upgrades to households that are not eligible for assistance through other channels.

- Whether the proposed method of delivery will provide the best value to the State of Maryland.

Secondary review criteria include:

Download, review, and complete the  FY20 Application Form. Instructions for completing the application as well as proper submission procedure are included in the Application Form document. MEA strongly encourages applicants to fully review the application instruction prior to completing the application.

FY20 Application Form. Instructions for completing the application as well as proper submission procedure are included in the Application Form document. MEA strongly encourages applicants to fully review the application instruction prior to completing the application.

Emailed applications, the preferred method of submission, must be received by 11:59 p.m. EDT on November 15th, 2019. All paper applications are due onsite at the Maryland Energy Administration by 5:00 p.m. EDT on November 15th, 2019. MEA strongly encourages applicants to submit their completed applications at least one day prior to the deadline to avoid any technical difficulties that may arise. No applications will be accepted after the deadline.

Electronic applications should be submitted to MEA’s technical assistance contractor at:

[email protected]

Paper or in-person applications should be addressed to:

Maryland Energy Administration

Attn: LMI Program - FY20 Application

1800 Washington Boulevard, Suite 755

Baltimore, MD 21230

LMI Application Webinar

MEA strongly recommends that each potential applicant view the LMI Application Process webinar. This webinar covers an overview of the LMI program, explains the application process, and covers the anticipated timeline for Grantee selection.

The webinar can be viewed here.

Center_Content

Additional Questions

Please direct any questions about the LMI Grant Program to Dean Fisher 410-537-4068.